The Great Gold and Silver Breakout of 2020 Is Just the Start

Since taking over as editor of this newsletter,

I haven’t really spoken to you about my love

affair with precious metals. P’ve advocated for and

owned gold since 2002, when I bought my first

1/10th-ounce U.S. Gold Eagle coin and a tube of 20

1-ounce Silver Eagles.

Writing about gold seven years ago for

Newsmax, I was singularly focused on the

metal from a monetary perspective. Going back

thousands of years, gold has been the “canary in

the monetary policy coal mine? In centuries past,

it would always call into question the value of the

paper currency circulated by either private banks

or governments as people hoarded gold whenever

their confidence in the bank or government failed.

Today, gold is the thing

which the central banks

ultimately cannot get away

from, no matter how hard

they try. But what became

obvious in the fall of 2013

when gold broke down

below $1,400 per ounce was

that precious metals were

just starting a grinding bear

market that would need a few

more years to work out.

When central banks came together in late

2011 to coordinate policy and create massive

slush funds between them to support asset prices,

it forestalled the day when gold would call

their bluff. The banks had restored the market’s confidence in them for the time being because

market participants wanted stability, even if it

was temporary.

They still believed enough in the

government to keep working with the system

rather than against it.

Gold and silver became the primary victims

of this new paradigm of coordinated central bank

policy for a time. It forced me to rethink my

position on gold and the markets in general.

However, our leadership hadn’t solved the

underlying problems that caused the 2008 financial

crisis, nor had they solved the fundamental errors of

their economic theories.

Because of that, the downstream effects of

this policy were predictable. For gold bulls like

myself, all we had to do

was wait. Eventually, gold

and silver would reassert

themselves once the central

banks reached the limit of

that policy, as economic

deterioration of western

societies manifested itself as

a series of political crises.

This is why, over the

intervening years, my focus

shifted into politics. I know, at times, I spend more

time on that than some of you are comfortable

with. But there is a method to my madness —

because these events provide the insights as to

when the trust in government, and by extension,

the central banks, would fail.

In 2011, the time wasn’t quite right for

confidence in government institutions to collapse.

We still believed they were capable of redemption.

In 2016, that was what the election of Donald

Trump to the U.S. presidency and the Brexit vote in

the U.K. were supposed to tell the people in charge.

But the powers that be didn’t listen. Instead,

they doubled down on their corruption, spent four

years undermining Trump’s presidency and Brexit

negotiations, and have now fired the first shots

in a civil war that is intended as the last attempt

to regain control over the future of the West and

institute tyranny under the rubric of saving the

planet from climate change and systemic racism.

After four years of this insanity, they’ve pushed

too many people past their breaking point. The

chaos in the streets, the uncertainty of our financial

futures, the fearmongering over COVID-19, the

attacks on communities and common decency

in the service of what is clearly a cultural Marxist

agenda akin to China’s Cultural Revolution, has

people shifting their priorities in a profound way.

So, while 2011 may not have been the year for

faith in our political leadership to fail, 2020 most

certainly is. This month, I’m going to focus on

how this failure of faith has led to historic moves

in both gold and silver, and why I can now safely

expand our exposure in our portfolio to silver, in

particular, since we are already well-positioned in

the gold half of the market.

The Dollar Holds Its Own - For Now

It is because of this failure of faith that we’re

finally seeing gold and silver make the kinds of

explosive moves they’ve had the past few months.

Gold is regularly called the anti-dollar and it

fulfills that role at times. Yet, it is more than that.

What many gold analysts (including a younger

version of myself) fail to grasp is that gold is

a reflection of our faith in the stewards of our

economic and political system — and that faith

cuts both ways.

Over the long run, gold will rise versus the

dollar as the government debases the dollar to

pay for its promises. But it will also fall versus the

dollar in the shorter term when public confidence

that those promises can be kept is high. It’s when

those promises can’t be kept that gold asserts its

power over markets.

At this moment, with gold reaching new all-

time highs and silver breaking out of a seven-year

doldrum, gold punters all over the financial space

are proclaiming the death of the U.S. dollar. I think

they are putting the cart before the horse, however.

Yes, the dollar is certainly being debased, but

those pundits are only looking at the supply side

of the dollar market. They aren’t considering the

demand side. If they did, they would finally have

to face the reality that they were wrong about gold

during the depths of the bear market, like I did.

Maybe that wouldn’t be good for their business

or their ego, but that’s not my place to say.

What I can tell you is that, if the U.S. dollar

was truly about to be destroyed, it wouldn’t still

make up more than 60% of central bank assets the

world over. People wouldn't be hoarding it to the

point where there are more dollar notes out there

with Ben Franklin’s face on them than George

Washington’s. The U.S. Treasury Department

wouldn’t be able to field massively successful bond

auctions across the entire spectrum of the maturity

curve at historically high prices in unprecedented

volumes if there was no demand for the U.S. dollar.

Don’t let the fiction of the U.S. Dollar Index

(USDX) fool you. It is in a bear market right now

thanks to a counter-trend rally in the euro and

the historic moves toward political and fiscal

integration recently made by the European Union

—a subject I talk about in my Thursday podcasts.

No, the reality is that while the Trump

administration did indeed print trillions of dollars

in the wake of the COVID-19 lockdown and the

seizure of the financial markets after the halving

of the price of oil back in March, most of those

dollars have been withdrawn from the financial

system in recent weeks. Commercial and central

banks extinguished temporary repo agreements

and called in swap lines with the Federal Reserve.

The Fed did its primary job during the crisis.

It created unlimited amounts of elastic money to

cover short-term time mismatches in U.S. dollar

liabilities. Hundreds of billions of dollars’ worth of

interbank “payday loans” have been paid back.

Now that the first phase of the financial crisis

is behind us, we’ve seen people let their guard

down a bit. Because of that, the extreme levels

of dollar hoarding have abated, causing some of

those dollars to circulate. But the moment another

seizure grips the financial system, that same

behavior will occur, and the dollar will rise sharply.

But is this bad for gold? In the very short term,

in the midst of the crisis, yes. In the long term, no.

All you have to do is look at the gold price

since March to see that. Gold corrected from

around $1,700 per ounce to a low of $1,450,

holding long-term support on its chart. Then

it blasted higher without pause all through the

second quarter of 2020 and now into the third

quarter, where it hit a new all-time high.

We're apt to see a replay of those events in the

coming weeks in the runup to the election, so be

warned. Like all things, gold does not go up ina

straight line. In fact, I fully expect some kind of

blow-off top and then a very sharp correction.

Gold, however, has been in a bull market

since setting its low in December 2015. What it

has finally done is bested its all-time high, and it’s

now free to make us a lot of money over the next

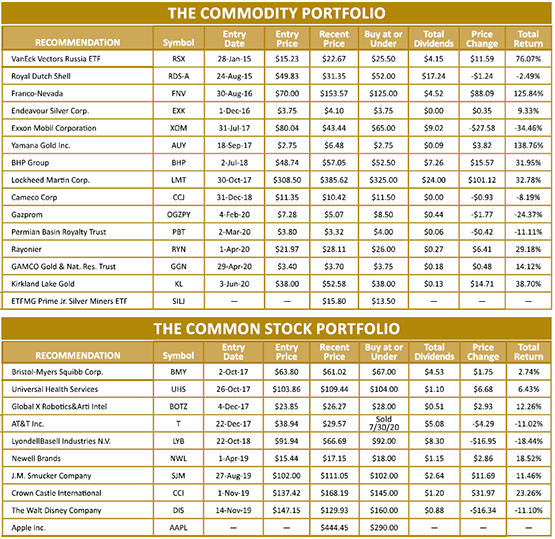

couple of years. Stocks like Franco-Nevada (FNV),

Kirkland Lake Gold (KL), and Yamana Gold

(AUY) have rallied hard during this most recent run

and should provide pure profit from here on out.

But gold’s story is relatively simple. Silver’s, on

the other hand, is more complicated because it ties

into the deteriorating general economy.

A Silver Lining

Silver is no longer primarily a monetary metal.

Per Austrian School economist Ludwig von Mises’

regression theorem, a commodity can only rise

to the point of being money if its demand as

money far outstrips all other applications of that

commodity.

This is why land, oil, and copper, for example,

are bad commodities to base a money on. They

have alternative value in the market. For centuries,

silver had limited industrial value, which is why it

competed with gold as a monetary metal. But in

the past 70 years, silver’s demand as an industrial

metal has skyrocketed.

That places it firmly along the same path as

copper as a former money. Governments have

liquidated their above-ground stockpiles of silver.

It is no longer any part of our coinage and hasn’t

been for over 50 years.

While the contrarian in me screams that it’s

possible during a big economic and political

dislocation, like a real pandemic or breakdown

of society, silver would reassert itself as day-to-day

spending money, I’m not holding my breath nor

making strategic decisions based on the idea.

This, in short, is why silver has lagged behind

gold in establishing a new bull market stance.

During a bear market and times of high faith in

government effectiveness, silver will trade on its

commodity character, moving more in sympathy

with copper or lead than with gold.

But it still has some utility as a monetary asset,

much more so than copper. And so, when gold gets

too expensive, silver will rise quickly to make up

for lost time.

This is exactly what we saw in July and early

August. Silver went ballistic once it broke through

short-term resistance between $18 and $18.50

per ounce. And once through that level, even the

post-Brexit vote 2016 high of $21.13 (all prices cash

basis) proved no match for the underlying demand

for silver. It quickly pushed up into the high-$20s.

There is, however, a second circumstance giving

silver its wings — the growing understanding that

there will be no real economic recovery in the U.S.

because there is no solution to tens of millions out

of work, whole industries like entertainment and

dining undergoing massive reorganization, and a

political knife fight in Washington, D.C., that will

claim a lot of victims.

Couple that with massive stimulus from Trump

to counterattack against the civil war declared by

the Democrats and the oligarch class, and we'll

have a whole lotta money chasing the same (or

lesser) amount of goods.

The supply of silver could tighten further over

the next year. The reality is that a lot of mining

companies that were already shuttering marginal

production in silver before March are not eager

to restart production until there is some kind of

lasting move higher.

Take one of our holdings, Endeavour Silver

Corp (EXK). It shut down its El Cubo mine in

Mexico in 2018. It had to: El Cubo was costing the

company $20 per ounce to produce into a market

that valued silver at $14 to $16.

Endeavour’s story resonates across a lot of the

mining space, and that dynamic will continue to

put upward pressure on commodity prices based

on the supply of money and the lack of supply of

metals.

This is why copper, seemingly out of nowhere,

rose back to $3 per pound. In the bigger picture, silver has both this “cost-push

inflation” pressure (i.e., inflation

driven by increasing wages and raw

materials costs) driving it higher,

along with the remnants of its

monetary character giving people

the impetus to buy it rather than the

more expensive gold.

silver has both this “cost-push

inflation” pressure (i.e., inflation

driven by increasing wages and raw

materials costs) driving it higher,

along with the remnants of its

monetary character giving people

the impetus to buy it rather than the

more expensive gold.

But, that said, I haven’t told you

the best part yet. Silver is literally just

getting started.

Gold breaking above its post-

Brexit 2016 high last year was a

pivotal moment. That set the stage for

the new all-time high of $2,069.21 an ounce set on August 6. It was a huge

technical breakthrough that signaled

long-term sentiment in the market had changed

from uncommitted to bullish, ending six-plus years

of meandering around the desert.

Silver finally achieved what gold achieved

last year, breaking out of a massive bottoming

pattern that now sets it up, regardless of any future

pullbacks, for a run to its all-time high of $49.54

(set in April 2011) and beyond.

One important aspect of how I view markets is

to see key technical signals propagate through time.

If I see something significant during a particular

day, the first thing I do is check to see if it’s

important from a weekly perspective. If the weekly

is significant, then I check the monthly, and so on.

Silver’s move in July and August was significant

all the way out through the yearly time frame (see

Chart 1). Although we haven’t closed 2020 yet, we

did close July above that important 2016 high of

$21.13, which is still a very strong signal. The signal

will get stronger if silver closes above that price at

the end of September, creating a quarterly breakout.

Adding all of this together puts silver in an

excellent position to begin its last bull market

on monetary and political chaos. Why last?

Because during this next bull market, there will be

fundamental changes to the way we view money

and how we hedge against government overreach.

I’m speaking specifically about bitcoin here.

The advent of a money where no human has a say

over when and by how much it will be inflated

through time is the most significant aspect of it.

In all markets, new technology eventually

obviates old technology, and in today’s world

digital money will outcompete physical money.

The question isn’t if it will happen or even when it

will happen, but how it will happen. Will private

currencies like bitcoin overwhelm government

currencies due to a loss of faith in the dollar,

euro, and yuan, among others? In response, will

governments act even more forcefully to defend

their monopoly power to create money and confer

privilege through its issuance? Or, will another

catalyst for change rise?

At this point, they aren’t answerable to any

great degree, but the one thing that I can say

here is that we're in a transition period from one

monetary system to another. During such transition

periods, commodities without counter-party risk,

without someone else holding a claim against that

commodity, are the ones that perform the best.

Buy Alert: Mining for Opportunities

In short, when things get crazy, people get real.

That’s why I expect silver, gold, and bitcoin to all

reach new highs in the coming months and years.

They may trade at levels that defy description

today. But let’s not get too far ahead of ourselves.

What is real today is that silver is the hot

commodity after testing bulls’ patience for years.

After a massive runup off the March low, silver

will take a breather and pull back to re-test the

breakout area around $21.

So much of the space is overbought now that

I’m not crazy about buying into silver until that

correction completes. At the same time, there are

few companies in the space whose balance sheets,

exploration plans, and business models all line up

for a singular stock pick.

Frankly, we're already in the one silver stock

I would have picked at a moment like this,

Endeavour Silver. Endeavour has blasted higher

on good news with respect to the revaluing of its

Terronera property in Mexico and on silver prices, which will improve the profitability of its existing

mine portfolio. A stock which tried our patience to

the breaking point is now a winner for us.

And in looking over the space, I see either

junior exploration companies that are years from

developing mines or producers dealing with the

aftereffects of a nine-year bear market.

We're not buying silver for the tactical

positioning of a company to outperform the

underlying metal. We already did that. We're

buying silver strategically to get broader exposure

to one of the best stories in markets right now. This

is why I’m recommending we add an ETF here

rather than a particular stock.

In today’s markets, the people who will be

investing in silver will be doing this exact thing,

but they will be blindly following the silver price

and they will push the undervalued stocks in the

sector up rather than pick individual winners.

An aside first: I considered adding Wheaton

Precious Metals (WPM), but a combination of a

massive price increase and the fact that we already

own a royalty streaming company like Franco-

Nevada nixed that idea. Wheaton is far more

streamlined around silver than Franco-Nevada,

which makes it attractive here, but I think there

may be more upside in the beaten-down mining

stocks that make up the bulk of ETFMG Prime

Junior Silver Miners ETF (SILJ), which is my

official pick for our Commodity Portfolio.

SILJ is a small ETF with only $276 million in

assets under management (AUM). The big thing

here is that more than $200 million of those AUM

were added this year, and $175 million since April

1. There is a lot of upside here for this ETF to

simply add AUM during the bull market. Fund

flows in will force buying of its holdings, and any

good news from the companies themselves will

create a self reinforcing feedback loop.

Silver is my pick for the next mania in the

capital markets after the next correction, as investor

money rotates out of the NASDAQ 100 and into

commodities and gold — people will be looking

for the certainty of the real rather than the promise

of the future.

That said, I think SILJ and silver are

overbought. Silver should pull back to the

breakout level of $21 per ounce. SILJ has greatly

outperformed silver since March and ended July

trading at a historically high multiple versus silver,

which makes sense.

Correcting for that ratio and a $21 price for

silver creates an ideal buy-in price for SILJ at or

under $12. However, we should give ourselves some

wiggle room here, assuming much higher silver

prices in 2021, to ensure we get a position, and set

our target a little higher. I recommend buying the

ETFMG Prime Junior Silver Miners ETF (SILJ)

for the Commodity Portfolio at or under $13.50

per share.

Sell Alert Recap: AT&T (T)

We've added one stock to the portfolio, and in

an email trade alert I issued on July 30, it was also

time to remove another.

Last year, I recommended Walt Disney Corp.

(DIS) on the strength of its Disney+ streaming

launch and what I sensed was a strong adjustment

to its Star Wars strategy. At the same time, we

continued to hold AT&T (T). As a Dow Jones staple

and higher-yielding stock, I felt it would ride the

coattails of the shift in entertainment away from

public events to a post-COVID-19 world where

staying in would become the norm.

Since then, AT&T’s rollout of its streaming

service, HBO Max, has been anything but smooth,

while Disney continues to hit home runs with

Disney+.1 have zero use for Hamilton and its

“woke” underpinnings, but it is hard to deny how

well it has done for Disney in recent weeks.

Moreover, Disney has done nothing to overtly

antagonize and exacerbate the cultural revolution

taking place across the U.S. right now. In fact,

Disney, like Apple (AAPL), has kept very quiet

on the subject, as I mentioned last month when I

provisionally added Apple to our stock targets.

AT&T, on the other hand, has thrown all

in with the major social media companies by

allowing its Time Warner subsidiary to run wild

sabotaging its own brand. CNN has become a major liability for AT&T. Its ratings continue to

plummet. It has become a parody of itself during

the years when it garnered the moniker the

“Clinton News Network? And the simple fact is,

Warner Media is not being run for the benefit

of shareholders but rather to pursue a political

agenda: that of defeating Trump and ushering in

a form of governance antithetical to the future of

capital formation in the U.S.

Any company so thoroughly mismanaged

that is not revamped at the board level reveals

a leadership that does not care about its

shareholders. Jeff Zucker should have been fired as

the head of CNN years ago. He remains. Randall

Stephenson stepped aside as John Stankey became

both CEO and COO after putting the head of

Hulu, Jason Kilar, in the top spot at WarnerMedia.

Stankey is way too close to the DNC for my liking.

Looking at this quarter’s earnings report —

which was horrific — it’s clear that the people

who were most responsible for those numbers got

promoted while the board simply shrugged, letting

shareholders get gutted.

AT&T has immense promise as a company.

It has a ton of moving parts, all of which could

generate strong revenue and margins. But under

Stephenson and, I expect, Stankey, nothing will

change soon as the company bets the farm on Joe

Biden beating Trump.

That’s a sucker’s bet, frankly. If gun and rural

property sales are any indication, Trump will win

the election in a walk, barring outright thievery.

I wouldn’t want to be any media company that

crossed Trump as hard as AT&T has when he’s free

in his second term to exact his revenge on them.

I fully suspect that he will. Meanwhile, because

of its poor leadership, AT&T will languish and

make both our Disney and Apple positions that

much more attractive.

I cannot countenance having a company like

this in the portfolio with year-over-year contraction

in markets that are booming, an absentee board,

and politically motivated leadership. Content is

going to move directly “non-woke” in this next

phase of the culture war, and I’ve seen little from

AT&T’s leadership or its WarnerMedia division commodities important to stocks in our portfolio.

which tells me they understand this. The first is lumber. Lumber futures jumped past

If you haven’t acted yet, I recommend selling

AT&T (T) from the Common Stock Portfolio at

market price upon receipt of this issue.

A Look at Lumber and Uranium The last things to discuss this month are two commodities important to stocks in our portfolio. The first is lumber. Lumber features jumped passed previous prices resistance levels at $450 per 1,000 board feet, exploding to their highest prices in nearly three years. Previously, lumber prices crashed along with the overall stock market in December 2018, and only began recovering after the massive market tumber in March. Lower oil prices and supply disruption the

world over are now expressing themselves in the

futures price of lumber.

This is good news for our play in the space,

Rayonier (RYN). A timberland real estate

investment trust (REIT), it has industry-leading

land holdings in the Pacific Northwest, as well as

the U.S. Southeast and New Zealand.

There is a huge migration occurring out of blue

states to red states, and that’s fueling new home

building there which, along with the same cost-

push inflation effects I talked about earlier with

silver, is sending lumber prices higher. Rayonier

has rebounded nicely off its low, giving us a strong

31% return in a few months through July.

The other commodity that bears discussing

is uranium. Now, I'll admit I was unconvinced

of uranium’s price bounce earlier in the year on

the rule changes initiated by Trump to provide

investment funds to develop U.S. sources of it.

Prices jumped above $30 per pound for yellowcake

ore, and have not fallen off since, however.

Shares of primary producer Cameco Corp.

(CCJ), which we hold in the Commodity Portfolio,

have performed well in the past few months. In

July, the stock finally put in a strong close above

long-term resistance at $11 per share, indicating

there’s real investment demand for uranium after

nearly a decade of apathy.

It’s now around my “buy at or under price” of

$11.50, and I recommend picking up more on any

pullback below that level. Nuclear fuel demand is

only increasing, as I expect Russia’s state nuclear

power company, Rosatom, to continue adding to its

book of backlogged business, which a few months

ago they declared was more than $104 billion.

The uranium market is in even more dire straits

than the silver market, supply-wise, and I wouldn't

be surprised to see prices eventually push back

over $40 per pound as new reactors the world over

come online. Cameco is in good position to be the

best stock play overall in this sector.

Actions to Take Now

Action No. 1: Buy the ETFMG Prime Junior

Silver Miners ETF (SILJ) at or under $13.50 per

share for the Commodity Portfolio.

Action No. 2: Sell AT&T (T) at market price

upon receipt of this issue.

Action No. 3: Accumulate shares of Cameco

Corp. (CCJ) on pullbacks below $11.50 per share.

Keep your stick on the ice,

Ultimate Wealth Report Podcast Transcript

Gold Is Flying High, But Is It Still Undervalued?

July 9, 2020

Hello, and welcome to the Ultimate Wealth Report podcast for today, Thursday, July 9th, 2020. My name's Tom Luongo. We have a lot to talk about. I got three things for you this morning. Going to get right to it.

The second wave of the COVID pandemic, and I hate to use that word, is coming, but the real second wave is what I've been talking about and what I talked about in last month's issue, which is that the economic collapse is continuing, unabated, and there's not really very much the government can do about it at this point. And the Democrats are obviously trying to push the COVID second wave in order to try and make it worst for Trump as possible in order to get him out of office.

Second thing we're going to talk about is Ghislaine Maxwell, the lover of Jeffrey Epstein, who was arrested on Friday, and I'm going to give you some thoughts on what I think is going on there. Very short though. I've got other commentary in my public work that I think is more... I don't have time to do it here. I will urge you to go and look into that. And then the last thing we're going to do is we're going to talk about the markets, how all of this factors into what's happening and what we're seeing in the markets.

Let's get started. Let's talk about the second wave thing. They're really ramping up the fear porn on this coronavirus second wave with cases exploding. Of course, they're going to explode. You locked people down for four months when the kids should have been passing this amongst themselves that grant herd immunity. The testing is, at best, specious. The tests themselves are very, very inaccurate and they're doing everything they can to try and keep people radicalized into wearing masks in public. And now, we've got officials saying that we're going to have to wear masks in public and be shamed out of the public sphere if we don't just automatically walk out in public without a mask on. It's all insane.

This is a coronavirus. The best defense against coronavirus is sunlight, vitamin D, a little bit of zinc and some chicken soup. Immuno support is what's going to get us out of this, not Big Pharma, clearly. And Anthony Fauci is still talking out of both sides of his mouth in order to try and serve his Big Pharma, Bill Gates masters and frankly, it's pathetic. They're targeting Florida, especially, and they've been targeting this Ron DeSantis, the governor here in Florida, on purpose since March and I know why, and it's because Joe Biden doesn't have any path to victory without winning Florida. Okay? He doesn't have a chance at winning this election without Florida. They know that Florida is the key. They're trying desperately to make DeSantis look like he's killing people. It's crazy. It's silly. It's stupid. I don't think it's going to work, but we'll see.

The two states that this election will come down to were Florida and Pennsylvania. Texas will be fine and Arizona will be fine. I don't see any of those ... those are the big issues from Trump's perspective. Ignore the polls and ignore the numbers that you see as far as national polling is concerned because none of that matters. Some state polling is not great, but Trump's approval ratings amongst black people is higher than it's ever been for a Republican. This is why they're so desperate to try and push Florida. But I don't want to belabor that point because the real second wave is the economic dislocation that has been caused by all of this and that's where Trump is actually vulnerable because truth be told, 25, 30, 40 million are people out of work. They may just blame the president, even though he has nothing to do with this.

We've got 80% of restaurants in New York didn't pay rent in June. Now, Trump's not going to get blamed for this and it doesn't matter what happens because he's not going to win New York anyway. 50 million Americans have filed for first time unemployment so far. I'm just going through the headlines at Zero Hedge this morning and it's just a picture of wealth destruction. The big one is that California has a 2 million person backlog in unemployment payments and it's going to drive actually, house races that got flipped in 2018, could flip back. I could easily see a scenario where Trump barely squeaks by and wins reelection and the Republicans retake the house because at the local level, people understand where the failures are, where the failures of government are.

They're going to look at people like Gavin Newsom and these mayors, and they're going to go, "I'm not going to vote for this anymore." You could see urban districts around this country flip Republican. Walgreens is the early part of Q2 earnings season and they missed badly and they're announcing 4,000 jobs have got to go. Big deal. Now a lot of that has to do with the UK, but still, I was looking at the article this morning. The June budget deficit for the United States government was $863 billion in June. Expect numbers like that going forward.

And the big one is commercial mortgage-backed security, nonperforming loans over ... been telling you for months that commercial, the CMBS, NPL rates, that stuff is important because those commercial mortgage-backed securities have been a staple of state pension funds to get their seven, 8% yield that they need. And they were never AAA. They were never any good, but when credit's expanding and there's no risk allowed to be entered into the system, we can create whatever yield we want. Once that dynamic changes and those mortgages aren't being paid ... again, 80% of New York City restaurants didn't pay their rent in June. Once that happens and the malls are dying and we're seeing bankruptcy wave after bankruptcy wave. Was it Brooks Brothers this week, right? That's going to destroy the state pensions.

They've been living on two things. They've been living on a commercial and real estate. Well, three things. Commercial real estate, which is now rolling over. Cheap fracking debt, which is already gone and buying the dip in equities. And I fully expect to see a melt up in the NASDAQ and then a crash and it's because of the Dow. The Dow refuses to break higher so that this bifurcation is split between the NASDAQ going ballistic and the Dow struggling at 26,000. The Dow is going to pull the NASDAQ back down in the same way that, for a long, long time, silver pulled back on gold. Now, gold is going to take silver higher and we'll talk about that in a little bit.

I think between now and the election, Trump will do another round of middle-class stimulus. I think he's got a lot of money saved up from the first round of the stimulus to throw it back out again to the people. There's a lot of unspent money out there. He's going to get pushed back from the GOP. Mitch McConnell has obviously been paid off to not support Trump this time around and the Senate is not going to support him. They all want him gone. Democrats like Mitt Romney and Lisa Murkowski and Susan Collins are not going to show up to the GOP convention. I think that's a good thing. We'll see what happens.

All right, let's talk about Ghislaine Maxwell real quick. All that stuff is coming and it's all going to come to a head later in this quarter and then as we get closer to the election, I think that's the timing on all of this. Let's talk about Ghislaine Maxwell. This is about a lot of things. It's absolutely about Obamagate. It's absolutely about the Clintons. The lawsuit and the fight for control over the Southern district of New York's U.S. Attorney's office, it's about Brexit as well as Israel and everything else. All of these things are tied up in the Maxwell-Epstein thing. I can't go into all of it, but I can tell you that I did a 30 minute podcast the other day, trying to explain why I think Trump and Barr are pushing this ball forward, what their strategy is, and why it dovetails in with Brexit of all things, because that was the thing that finally made some sense to me when I finally put all back together with Prince Andrew and all the rest of it.

And you guys know how closely I watch European politics and because of that, again, this may just be me. We've got a hammer. Everything looks like a nail thing. That's very possible, but I also feel that the Israeli angle's pretty strong as well and there's a lot going on here in the fight between a Ehud Barak and Benjamin Netanyahu. Part of this is a messy fight between them. Of course, Trump is caught in the middle of this and if Trump can get an advantage here, he's going to take it. If he's got some way of taking all the information that Maxwell and Epstein have and use that to start scaring very powerful people all around the world, because they killed Epstein to stop this. Now the bigger question is, not Trump and Barr, but the bad guy. If that's the case and they've got Maxwell's information now, and they can open up the Epstein files and they can open up Anthony Wiener's laptop and all of the rest of it, now they can actually start going after the bigger fish.

And I don't just mean directly related to Epstein and Maxwell's blackmail schemes. I mean, that it allows them to go after the funding for Antifa. It allows them to go after a lot of other things that are happening. It allows them to go after Obama. I think there's an Obamagate angle here that allows them legally, to start gaining access to things that they're not supposed to have, that nobody wants them to have. Remember, Epstein and Maxwell have been blackmailing people going back into the 1990s. There's everybody, from in British intelligence, the Mossad, the British Royal family, the State Department, the Clintons, Wall Street. Everybody is dirty here at a certain level and it's all tied together, Ukraine, Biden, all the rest of it.

I fully believe that Trump is a guy who has nothing left to lose, and he's going to try and take down as many people as possible before they show him the door. And if he wins in November, then it can be a very interesting second term. That's what this, I think, is all about. I absolutely believe that Trump and Barr are driving the bus here and that the bad guys, for a lack of a better term, are on their back foot, trying to contain problem and trying to firewall everything. And when you've got them in that position, that's always a good thing. Operational tempo is important here.

The last thing I want to talk about this morning are the markets. Let's get into it because obviously, that's why we're here, right? We're here because we care mostly about stocks and our portfolio and all the rest of it. Let's talk about the big, 800 pound gorilla in the room, which is now trampling the room left and right, and that's gold. Here we are. Gold's back above $1,800, both in the cash market and the futures market. Very, very significant. The Hutu close that I said was significant, having closed above $1771, set the stage for their follow through and I'm actually really... In some ways, I'm almost surprised that we got this strong a move now. I was hope... Not hoping, but expecting more of a pullback. We got a two day pullback on the first two days of July, from $1800 back down to the $1770s in the futures market and 1780 down to the $1750s on the cash market.

And then it just exploded again after the 4th of July and that's huge. And now we're above $1,800 because gold is realizing that government can't solve these problems and government institutions don't have any good solutions. Trump is right to be going out there and now running on a symbolically, potent campaign, tradition, and monuments and stopping the violence and all the rest of it and he's allowing the Democrats just enough rope to hang themselves, I think it's going to work out for him in the long run. It looks bad now, but like everything else, sometimes you have to let your opponent massively overcommit to the wrong side of the trade in order to push him into the abyss. And he may have learned this from Vladimir Putin, who's a master at it. You want to know who somebody who would have taught Trump that lesson because Trump is absolutely a straight ahead, bull in a China shop, gangster-like figure, it would have been Putin.

Look, you're going to have to draw these people out. You're going to have to feign weakness and allow them to come after you and then when they've over committed, then you can reverse them very easily, which if you look at the overall strategy for how Trump has survived in the White House for the last four years, that's what he's done and I have to give him credit for that. I still hate his foreign policy to hell and gone, and I think it's terrible. And when we're behind all of this stuff and he's still in power, we're going to have a long discussion about Trump's foreign policy and why we're along Russia. I'll be honest with you.

If I could go along Kazakhstan right now, I would, and verboten in these... If I could go along Iran, I would, but I can't. And that's not me saying this from any emotional perspective like, "We're wrong. Iran's right," or anything like that. This has to do with, the Chinese are dumping $280 billion into Iran, which is 40% of their GDP over the next 10 years.

There's going to be great opportunities there, similar to Pakistan, going along Pakistan about four years ago, when China dumped $55 billion in the Pakistan in a year. Good opportunities there. You could have easily bought the Pakistan ETF and doubled your money in three months, that kind of thing. All right, but back to gold. Gold is sniffing out where people are very, very concerned and when people are concerned and you can see it now, we're in a depression. When that happens, their time arise and shorten. Credit card balances are collapsing. The savings rate, in effect, is rising and people aren't spending on their credit cards, not going farther into debt, then it's not measured in the savings rate, but it is a form of savings. The fed hates that and gold and gun sales are at record levels. I think I saw a number the other day that through May, it was 8.3 million guns were sold in the United States.

Well, I can tell you, I bought four in the last month. Got my eye on a Brugger Mark Four of some flavor, along with a CZ 527 Carbine in a 7.62x39 because it's cheap to shoot and it's a great brush shot. The big thing here, and from our perspective, is that gold is massively undervalued, not just gold itself, but gold stocks. The quarterly report from GAMCO, the close-end fund, GAMCO Gold and Natural Resources Trust, made a very important point very deep in their analysis of what's happening with the fund's valuation, which is that gold stocks are trading at three standard deviations below historical norms versus the underlying gold price. Meaning, there's at least a 50% rise necessary in gold prices, in gold stock prices, just to match where we currently are because it's not like profitability for these guys is going to be down.

Oil prices are in the dirt. And the biggest ongoing cost for a gold miner is oil, is energy, and energy prices are in the dirt and they're going to be in the dirt for quite a while. What we're seeing here is that there's really not a lot of money in the stock market and a lot of it rotated out of the Dow before the crisis in March. And then after the crisis in March, it all rotated into the NASDAQ and only really, concentrated mostly, in about 10 or 12 stocks. And then once that breaks, there's going to be a rotation out of the NASDAQ and I think it's going to happen. It's going to go into the smaller cap stocks. We're going to start looking at a... People will start looking at undervalued energy stocks that are still paying good yield and I think because we're going to start to see cost-push inflation in the commodity sector, and I'll explain for that in a minute, and gold stocks as gold starts to make headlines at 1900, a new all-time high, $2,000.

And once that happens, gold will be the shiny object that everybody chases. And all of a sudden, companies like Yamana and Kirkland Lake and others are just going to explode in price, while well-run companies like Franco-Nevada still get institutional support and they just steadily climb. Royal Gold is the same thing. The speculative gold stocks are going to be big winners as gold moves into the next phase. I still think that there's going to be a correction in gold at some point, along with the equity markets. I think there's going to be another dollar spasm between now and the election. I think the markets are going to lock up. The overnight funding markets are going to lock up. It's going to force the fed back into the market, right? And right now the fed has backed off on all of its emergency measures. I think that's going to have to ramp up again.

There'll be another round of stimulus in response to that from Trump, and gold is going to... First, it'll fall like it did in March and then it'll snap right back again. It's going to get irrationally exuberant to the upside. Maybe in this wave up, we'll see gold hit $2,000. It's possible. It'll correct from there back into the $1,700s and then it'll explode to $3,000 or $4,000 in 2021 when everything goes crazy. That's where I think we are. I think supply chains are such a mess in so many areas of our economy right now, in oil and energy, in food and all the rest of it, that I think we're going to see collapses in companies and collapses in production, which are going to then translate into cost- push inflation in the future. And it's not going to be demand poll where the economy rises out of the ashes, like a Phoenix and roars ahead. I don't think that's what's going to happen.

I think we've got at least another year or so of, if not more, of very, very difficult times and then we're going to see supply constraints driving prices higher. Remember, prices can rise on two different reasons. The Keynesians, like to only focus on the demand. Can we stimulate demand? If we can stimulate demand, we've got rising prices and everything's good. That's one side of the market. The other side of the market is supply. They're going to try everything and they're going to throw the kitchen sink on all of this, and it's going to be crazy. But watch copper. Copper may be your early warning signal here that we're getting cost pushed in place because copper is now back above 280 a pound. Excuse me. And the breakout level of copper is 288 a pound. Let's watch for a monthly close here in July above 288 a pound in copper. That could signal that copper's willing to go back to $3.

Soybeans and corn prices are starting to rise. Soybean's back above $9 a bushel. Corn is threatening the upper end of its price range at 380 a bushel. Those are on... A finally a bad crop report in the mid... And after a year, the USDA finally admitting that corn planting's miserable. They're a million acres less than it should be and that's causing rotations in soybean prices and the rest of it. Think the fed will be forced back into the market at some point. And there's a lot of subsidies happening in our markets and the Chinese aren't buying our grains because they're mad at us, just like we're mad at them and that divorce between China and the United States is real and it's happening. It's going to continue.

Your market targets for this week are the same as they basically were last week, except for the fact that gold is broken out now. Watch gold here above 1820. It's running into resistance at the 1825, 1828, 1830 level, because the all time, monthly closing price high, which was in August of 2011, is 1828. That's where people are setting up their first line of defense in the short. That's where the shorts are setting up the first line of defense. We're starting to see resistance today between 1820 and 1830 because they're looking back on the monthly chart going, "Oh, yeah. That all time, monthly high. Let's set up there." Absolutely expected, and will that create enough resistance to force gold back down later? It's possible. We'll see. But I don't know. It looks, for the most part, to me, like gold is running the shorts right now.

Silver's looking to make a move this week above and hold $19. That's very possible.

Anything above 1850 in the cash market basis in silver is a major breakout. If you look at the weekly chart, you'll see exactly what I'm talking about. 1850 on silver would be good. Silver's got 40 cents of the downside over today and tomorrow, and it's still would be strong. I'd love to see $19 because $19, that would be actually above all resistance, going back almost a year, and that would give it an opportunity to then challenge the post breaks at high at around 21 or $22, and the short covering frenzy, which could happen on a weekly close of $19. We'll see, but I still don't think silver is ready because oil is trapped and refuses to move anywhere.

While copper's trying to rise and oil is building a base or possibly at $42, Brent Crude and silver is breaking out to the upside. I don't know. I don't just don't buy it because the oil numbers are terrible. The Saudis have no pricing leverage in this market now, which has to do with the Iran- China deal that was just announced. I've got an article up on my blog covering some of the ins and outs and some of my initial thoughts on this. I'm going to be talking about this Iran-China deal for the next six month, FYI. It may be as important a deal as when Gazprom signed the $400 billion, mega pipeline deal with China back in 2015. Okay. It's that big for Eurasian politics and for the future of the Eurasian land mass.

I'm going to get going. You guys watch the Dow to see if it can close above 26,000 this week. I don't think it will. Let's watch to see and see if we can get a blow off top in the NASDAQ. We're already seeing the stocks like Tesla go ballistic and parabolic. And when that happens, the crash is coming. Tesla could go to $1,800 and then it'll crash back to 800 or 600. If you don't believe me, just ask Bitcoin, which by the way, looks very constructive at $9,400 this morning. All right, you guys take care. You be well. We'll talk next week. Keep your stick on the ice.

Note: This document was created by an outside transcription service — it is raw and unedited, so please forgive misspellings and other unintentional errors. It’s presented for informational purposes only.

Ultimate Wealth Report Podcast Transcript

Gold Is Telling a Different Story Than Today’s Stock Market

July 2, 2020

Good morning and welcome to the Ultimate Wealth Report Podcast for today, Thursday, July 2nd, 2020.

My name is Tom Luongo and we have a lot to talk about. I've got three things for you this morning. I

want to talk about what I think is happening around July 4th and how the protests around the United

States are starting to change. What I feel is a slow-burning civil war that's been brewing, how that

tactically is changing. We're going to talk about that. I want to talk about what's happening in Europe,

because now that we're into the second half of the year, Germany takes over the presidency of the

European Commission. There's a lot going on there that just doesn't make the headlines and bubbles

behind the scene, but you can see it in the headlines. We're going to talk about that stuff, how that

affects the Euro political and fiscal structure going forward.

And the last thing of course that we're going to talk about after that, is we're going to go through the

markets. We'll talk about gold's really strong close to end Q2. What that means, what's going on with

the various U.S. indices, and how that affects news from this morning about the payroll numbers and all

of that stuff.

So, protesting is being replaced now by straight-up cancel culture. So now we're going to cancel our

past. Now we're toppling statues. Now we're canceling people like Stefan Molyneux on the right.

And in some ways that to me shows a sign of desperation, because they don't really have a good handle

on how to go forward here. The strategy just seems to be continue to throw whatever they can at

Donald Trump to make the numbers look as bad as possible, and to make the polling look as bad as

possible. And the polling is from my understand bad, it's not good. And I don't know what's going on

inside the Trump campaign. I read an article last night that says Trump is getting ready to dump Jared

Kushner, at least to stop listening to anything he has to say. That would be smart, because Jared is

terrible. But that being said, right now things look bad from a down and dirty every day rote situation in

terms of running a campaign. The Trump campaign doesn't look organized. It doesn't look right and it

looks to me, frankly I think Tucker Carlson's right about this. That the GOP is actively sabotaging Trump's

reelection prospects. And be honest with you, it almost looks like boats tides would rather lose with the person they currently

have, than allow any fundamental change to take place. So Trump still represents a populist wave of

change, right?

The Democrats don't want the insurgent Antifa crazies led by AOC and the rest of them in

the squad to take over. They don't want any change there. So they'd rather lose with Biden to Trump,

but at the same time the GOP would rather lose to Biden then another four years of Trump. So it's like at

this point, who wants the presidency, because... and it's going to come down to the convention for the

Democrats in mid-August. That's what's going to tell the tale as to how this thing is going to shake out.

I'll give you a small preview of it. I think Hillary Clinton is coming back, or at least thinks she's in the

conversation. I think a virtual convention makes it very possible for Hillary to put down any thought of

anyone other than her being the first woman president, because obviously anybody who votes for Biden

is voting for his VP candidate. So, if Hillary thinks that she can become president by having Biden at the

top of the ticket, and then having her in the background and thinks that today people hate her less than

they did four years ago. Well, she's delusional, but we've always known Hillary is delusional, so, shifting

back the cancel culture, watch the way they play this one out. Tactically and politically, this is now to

make Trump look bad.

First they made him look weak because he didn't respond to the CHAZ and he didn't respond to the

burning of Minneapolis and the looting in Atlanta and New York and all the rest of it. Actually, he looks

almost statesman like, if you want my honest opinion. Yeah, the Cernovich's and whatnot are all

screaming for him to have brought in the military and the rest of it. No, this is not the time to do that.

This is the time for County Sheriffs like the guy in Clay County to say, "Y'all come to Palatka, we're going

to deputize all the legal gun owners here." It's like the guy Grady Judd down in Polk County, people in

Polk County like their guns. And I'm telling you folks, when we really start to parse what's happening

here, over and over and over again, all the liberal cities and Democrat run liberal cities in Florida are

locking down over COVID. The whole second wave of COVID is another way of keeping Biden locked in

his gimp cellar if you want my honest opinion.

But in the rural areas of Florida, that's not going to fly. You have to remember that, of course the cities

have a lot of poll, but at the same time the cities are very divided. It is ultimately the rural parts of

Florida that will deliver far. Because there isn't really any massive majority in any of the cities in Florida

for the Democrats and for Biden. There isn't. Trump's approval rating amongst blacks is relatively strong.

Relatively speaking as strong as like 37%. Amongst Spanish it's very high and they can't win Florida

without the real blacks, and they're not going to get them. When a black sheriff in Clay County turns

around and says, "I'm going to deputize all legal gun owners in the county if you guys tried to come to

our neck of the woods." That's just telling me everything you need to know. And that's going to happen

over and over and over again. And it's going to continue to happen.

And yeah, all that COVID resurgence, every day it's now breathless. "Oh my God, there's all these more

cases. The hospitalizations are up." We went from 20 hospitalizations in Texas to 25. "Oh my God."

Second wave. This is the kind of gaslighting that they do over this. What they've done now is they've

thoroughly created a political issue, a political divide among people over wearing a mask. And I said this

back in March, that we're going to do this. It's disgusting and it's pathetic. And it's going to continue all

the way to the election and then they're going to try and pull it back after the election. I don't know that

that's going to work. I want you, two things to watch out for on this front, one, Fox News is going to

cancel Tucker Carlson before the election. His ratings are too high. He's too powerful.

And the second is, this weekend, don't think that Obama can resist the opportunity to destroy the 4th of

July celebration. He's too much of a vandal not too. So something's going to happen in D.C. this

weekend. All right, let's move on to Europe. The first thing I want you to do is I want you to ignore all

threats in the United States when it comes to the Nord Stream 2 pipeline, and I've been confident about

the Nord Stream 2 pipeline since it was announced back in 2015 or whenever, 2013, 2014. And there's a

major reason for this.

I've always thought just the economic and political situation for Germany was too compelling for them

to let it be stopped. And Angela Merkel being resurgent now as the leader of Germany and effectively as

the leader of the EU, again, at this moment in time tells you that Nord Stream 2 will not be stopped. But

the threats from the United States over more sanctions put downward pressure on the ruble, which is

fine. We get to buy more Russian stocks on the cheap. People get to buy more Russian bonds on the

cheap, which is what they've been doing.

And it's only making it easier for Russia to pay its bills. We're running even more massive trade surplus. I

wrote an article the other day that detailed that Russian Euros greatest trading at a premium to Brent

now. In Europe, usually trades at a two to $3 premium... what's the opposite of a premium? Discount to

Brent, okay. Because the market for it isn't as deep and as liquid. And guess what? With the Shanghai oil

contract being out there and giving a benchmark in the world for medium sour oil, we now know that

medium sour oil on a daily basis traded in Shanghai, trades at a slight premium to Brent, which trades at

an even bigger premium to WTI.

But going back Nord Stream 2, the main reason why Nord Stream 2 is going to be completed, is Gerhard

Schroeder, the former chancellor of Germany who left his job to then take a job with Gazprom, okay.

He

sits on the board of the Nord Stream 2 consortium. He's one of the most powerful men in Germany.

Never worry about it. Every time we put more sanctions on Russia over Nord Stream 2, you should be

buying Russian stocks, because Gerhard Schroeder is going to ensure that this gets finished, period,

paragraph end. Because we cannot stop that process. At this point, who else is there to sanction? You

can sanction the Russian ship laying the pipe. You can't sanction the Danish government for allowing

that ship into their waters. I mean, at this point it's just virtue signaling and the markets and these guys

continue to play these games in order to try and undermine the Russian political system.

And then we had the vote yesterday for the constitutional changes in Russia, and they went through

78% to 22% or 79% to 22%. It opens the way for Putin to be in power until 2036. Not that I believe that

Putin wants to be empowered until 2036, but until somebody steps up to be his replacement, he's going

to be in power until that. And Putin is relatively young and could be in power until he's 80 and the shape

he's in and the clarity of mind that he's in he can easily be very effective for another 10 years. Because

he's only like 69 or 70 years old. Tuesday end of Q two. And with the turning of Q two in to Q three, two

things happened. One, there will be no breaks at extension because that deadline passed. That's over.

Two, Germany takes control of the European commission presidency. I don't know if you guys know this. I know, I think I've talked about it before. That puts Angela Merkel in

charge of the next seven year EU budget.

They're in talks now about how they're going to do this bailout

package, which is really a debt mutualization package to the back door. It's a betrayal of all fiscal

conservatives in Germany. The biggest fiscal hawk in German politics. Wolfgang Schäuble, who is the

president of the Bundestag now and Merkel's former finance minister. He's already signed off on this,

because he realizes that there's no way out of this other than for the Europeans, other than to

neutralize all the debt. The ECB already owns most of this sovereign debt market. Eventually, sometime

in the future, they're going to cancel all that debt, converted to perpetual bonds. And so they're paying

themselves a quarter of a percent or whatever.

They're going to cancel all the debt. It's what's going to happen in Europe but that can't happen yet.

Right? Right now they're already determined that they're going to roll over to the ECB on this and to

Germany. Now they're just haggling about price, but all this is happening. The Euro's rising slightly

because now we've got... it looks like a bit of a recovery here in the United States, which they're actively

trying to destroy through this whole second wave of COVID-19 in the U.S. because they don't want a

rising economy coming out of the ashes for November, because that was the best chance Trump has to

get reelected. So now we have this ridiculous second wave thing happening in the U.S.. The Euro rising is

a function of the recovery narrative that's also happening at the same time, as they're trying to tamp

that down with the COVID-19 thing.

So we're getting a bit of a rise in the euro. That's fine. It's still unconvincing above a dollar 12. And it's

going to continue to be as long as it stays below a dollar 14, there's nothing really interesting to talk

about in the euro. Interesting though, here's the note, Christine Lagarde comes out yesterday and says,

"Well, COVID-19, it looks to be behind us. So we can start focusing on recovery now." Which is her way

of saying, we need to focus on this budget thing and all of that, right? And the getting this debt

mutualization package together, this grant structure thing, the full debt neutralization and move the

center of European power into the halls of the European central bank and the European commission and

destroy national sovereignty. This is that moment. That's why I keep talking about it and why I think it's

important, but all that's happening at the same time, a rising Euro is going to hurt the European

recovery process because it's a very weak economy.

They can't afford the Euro at a dollar 15 or a dollar 16, or a dollar 17. So if that were to happen while

they're trying to create a weak dollar here, which is insane, that will put up pressure on interest rates.

And we're seeing that again. I continue to tell you to watch for a breakout on the upside of German

bonds. Look at the German 10 years, it's going to be the easiest thing to find. You can find it everywhere.

And the breakout point there is minus 39 basis points on a daily closing basis, and then on a weekly

closing basis. We're staring at 41 basis, negative 41 basis points. Now it had collapsed negative 49, I

think last week, I think we even talked about this. Watch that carefully. As the guard is trying to hold

everything else in place, the German 10 year bond is trying to rise and that's not a recovery scenario. Okay. Let's talk about the markets. U.S. stocks are rising on a good payroll report this morning. The

headline unemployment's on 11.1%, but initial claims are still high at over 1.4 million and continuing

claims continue to rise. So there's something hinky going on with the numbers here. And it's probably as

much a function of just people being able to process their claims as much as anything else, but

Americans have been trying to go back to work.

And of course the Democrats don't want that to happen

because they want everybody's weak and desperate as possible so that they can blame Trump and have

a revolution and bring in dementia Joe. But as of right now, looking at the things that tell you whether or

not there's stress in the financial markets or not, we don't see any of that.

The plumbing all looks calm. The SOFR is under control. The Fed has run off a lot of the emergency

measures off its balance sheet that were there in April and May and looked like they were going to

break higher in early June but didn't materialize. I guess that's a good thing. But your big issue here is

that gold doesn't believe any of this. And while they're trying to create a weak dollar scenario, which I

don't believe, gold is telling you that a weak dollar scenario is nonsense. People are trading on safe

haven fears of a bigger breakdown and a bigger crisis. And if the Democrats are, and the powers the bait

are that committed to getting Trump out of power, what do you think is going to be on the horizon

between now and the election? There's going to be another September, 2008 style event, where the

market stays up. Whether they plan it or not, they want it to happen so they can help make it happen.

I hate to tell you this. I hate to even talk in these terms, but the stock markets are over rallied. Asset

prices are over rallied. It's not hard to then push on these overvalued markets and make them go in the

direction you would like them to go to cause as much political damage as possible. It's what they did

with the whole COVID-19 thing. Piling on the destruction of the oil price back in March. Watch gold very

carefully. We printed the highest quarterly closing price ever in gold on Tuesday. Gold never closed a

quarter above 1771. We closed at 1800 in the futures market and 70 in 86 on the cash market. Biggest

numbers ever. It's a huge moment where long-term structural investors who understand the big trends

and what's happening and to taking the big macro picture like I do, they're convinced gold is going

higher.

They beat multiple attempts on the New York open in that nebulous time between 8:30, when the

futures market opens and the stock market opens at 8:30 to 9:30 window, where they beat gold badly

with a stick. They pistol whipped it every morning and they couldn't hold it down. Once the equity

markets opened, people were buying GLD and there was nothing they can do about it. Big deal now. So

that's great. Our gold stocks, all look good because of this. And it also means that whatever's happening

now, even if there is a correction and gold gets hit in a correction because people sell their gold to raise

dollars when the next wave of dollar stress hits the markets where they fully believe we're going to have

some time in Q3. Again, if I'm wrong, I'm wrong, then gold was just keep going higher.

Then there'll be a great opportunity to buy gold stocks on the cheap, but don't believe that the

weakness is structural. It'll be just like it was March. You'll have the opportunity to buy great stocks at

unbelievable prices. And that's when you want to be a contrarian investor. So right now, if I'm holding

Nasdaq stocks, I'm looking to sell. The Dow is unconvincing above 26,000 and that bifurcation between

the Nasdaq breaking to all-time highs and the Dow's languishing below 26 grand and constantly playing

this game. Well, will she, won't she above 26,000? That bifurcation, that split, it's telling you that the

Nasdaq is going to have a blow off peak, and then it's going to collapse. How far it collapses? 10%, 15%,

30%. I don't know. It's going to collapse a fair amount. Dow's going to go with it. Probably 10 or 15%. Nasdaq will correct more. S&P 500 will correct between

the two of them. That's what the likely on the table. Gold would probably correct with that as well and

that's a buying opportunity. So if I'm a holder of Nasdaq stocks, I'm looking at selling right now. Who's

buying Tesla at $1,200 a share. Crazy people, honestly. And your big giveaway here is that oil is still

trapped. Silver is still mired below the post-Brexit high at 2016. Oil is still tracked between $40 and $45 a

barrel of Brent crude. There's nothing interesting going on in the oil chart.

It's just sitting there. And

copper prices are rising, which is always a leading indicator of commodity stress and possible demand

poll economic activity, demand poll price rise in the general markets.

Dr. Copper, copper's at $273 a pound, but it's not interesting until it gets to $287. So this is just a bear

market rally. It's got to get above $287 on a weekly closing basis to even become interesting. Because

then it could possibly trend change, confirm a low, which is probably the low in copper is probably yen,

at around $2 a pound. But just because it confirms a low, doesn't mean that we're going to have a new

bull market. Copper could trade sideways for five years before breaking higher. And given the

fundamentals and given the massive amounts of dislocation all across all sectors of the economy, the

bad news is going to start hitting really hard in Q3. That's when the bankruptcies are really going to rise.

That's when NPLS are going to truly explode out, to levels that we've never seen before.

I think they're already there. Non-performing mortgages, I think they were already at levels that we

never even saw during the 2008 financial crisis. So why is anybody talking about a V-shape recovery?

Because they have to, it's not real. All right guys, so your action items for this morning, a couple of

things I want you to watch. Watch the Dow around 26,000. Watch to see if it can close above that this

week. It may, but again, watch for it. This 25,000 to 26,000 range is really important in the Dow. Look for

signs of a blow off top in the Nasdaq. We're 10,360 this morning. We could get a massive move up and

then eventual collapse. Watch gold. This profit taking happening in gold right now, but don't be worried

about it. We closed the quarter at $18.00, gold being whacked again, pistol whipped again this morning

down to $17.70, $17.65 is a retest of the breakout level. That's actually very healthy market action. So

watch that as well. Watch for silver to try and put it in a monthly close, sorry.

Let's, start with a weekly close above $18.25. That would be a good start. We got a quarterly close

above 18.25, but that's not really interesting. From a weekly perspective, silver's being managed or

silver's got significant resistance above $18.25. That's also interesting. And then watch for oil Brent

crude to break out of the gap fill on the weekly chart, which should be doing $40 and $45.30 a barrel.

Watch for a weekly close above $45.30 in oil. If so, then we're going to have a continued reflation trade

in the markets. This bull run will continue to rise. Will continue to go higher. Gold may stay under pressure. The higher this goes without a significant correction, the more violent the correction will be on

the downside, all right.

So that's what I've got for you this morning. I hope that was enough. I hope that was interesting. If

you've got any questions, as always send them in the Newsmax Customer Service. I'll either address

them here in the podcast or in the newsletter directly. You guys take care. You be well. We'll talk soon.

We'll talk Thursday. Be good. Keep your stick on the ice.

Note: This document was created by an outside transcription service — it is raw and unedited, so please

forgive misspellings and other unintentional errors. It’s presented for informational purposes only.